Riding Paperplanes: Reality vs Fiction

Oct 2025 · Gold · Equities · CAPE · Central Banks · Valuations · Concentration Risk

A paper plane glides because the air is calm and the angle is just right. It looks effortless—until the room changes. Lately, markets feel like that room: quiet enough for a graceful flight, restless enough that a sudden swirl could fold the wings.

Two stories share the same sky: gold getting heavier in official vaults, and equities catching lift from a narrow band of engines.

Gold Positioning: China and the Central-Bank Bid

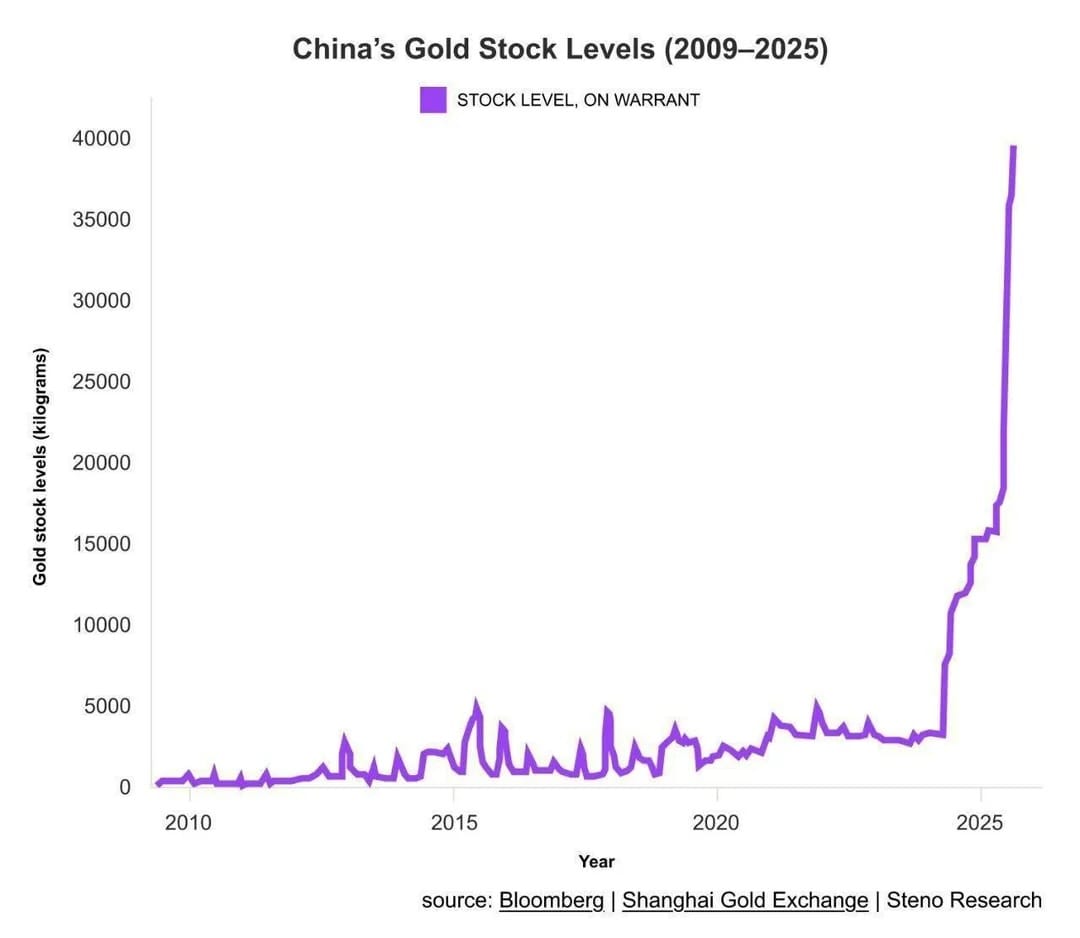

Picture a vault ledger updated month after month. China has added to its gold reserves for eleven straight months (through Sept 2025), taking reported holdings to ~2,300 tonnes. In Shanghai, SGE stock levels sit at records; imports are firm; custodial services expand. The signal isn’t loud, but it is steady: a preference for assets that don’t depend on anyone’s promise.

Oct 21, 2025 update. Gold hit a record near $4,381/oz and then dropped about 6% to ~$4,082—its biggest one-day fall since 2013. The pullback came after a huge year-to-date run (about +60%) as many investors took profits, the U.S. dollar ticked up, and upbeat U.S.–China headlines briefly lifted risk appetite. Silver fell too, and gold-miner shares & ETFs slid (e.g., GDX ~–9.5%).

Big picture: it looks like a sharp air pocket inside an ongoing trend—central banks are still adding gold, and it remains a widely used hedge when trade or tariff dynamics shift.

Caption: China’s gold stock levels (2009–2025); ranked official reserves, mid-2025.

Market Breadth: The Thin Ice Beneath the Rally (with CAPE)

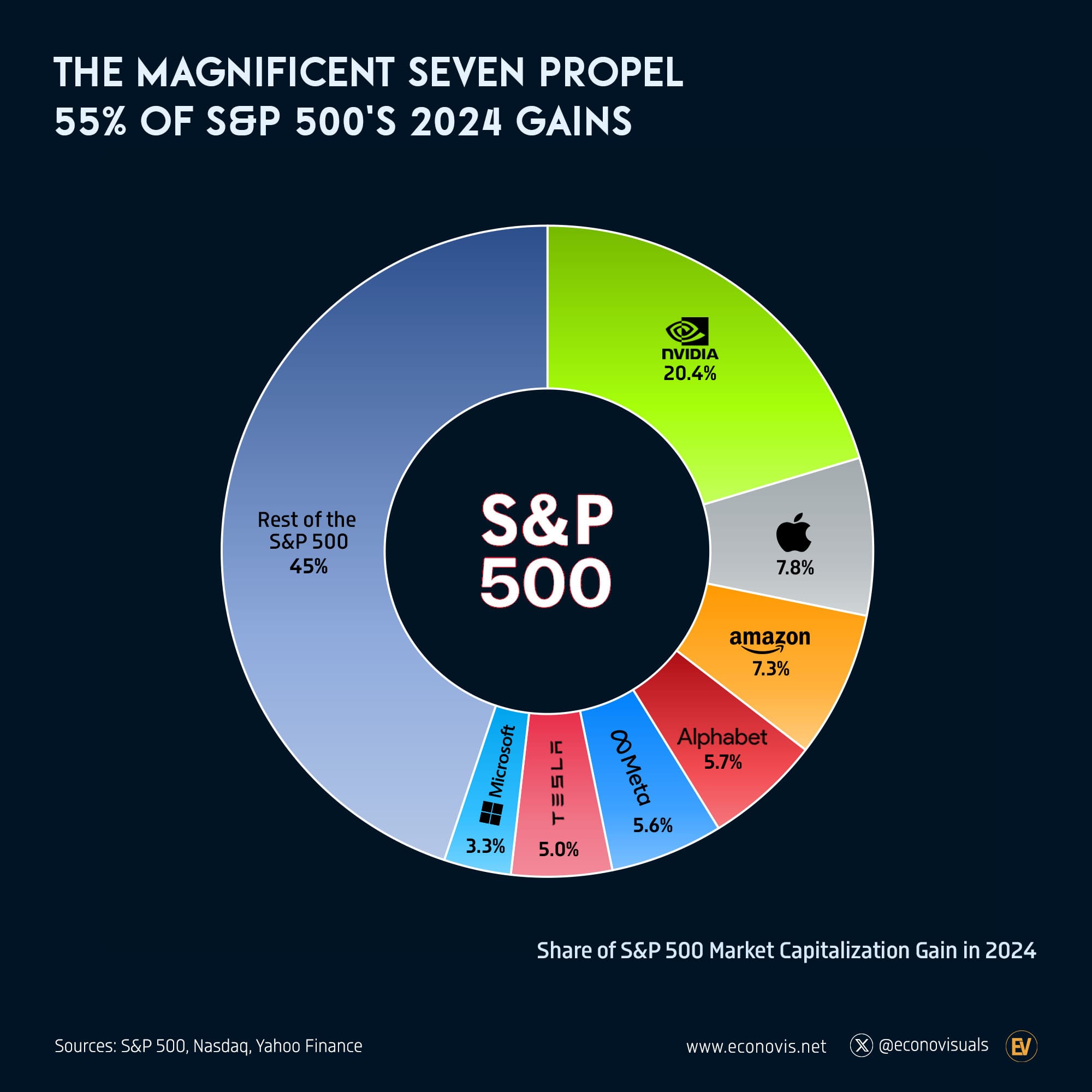

From 30,000 feet the index looks confident. Down on the surface, most of the weight sits on seven shoulders. The “Magnificent 7”—AI-centric mega-caps—do the heavy lifting, turning the S&P 500 into a story about a few companies rather than an economy of many. Narrow leadership can carry a market far; it also makes the ice thinner than it appears.

Credit: Econovis (econovis.net); data from S&P 500, Nasdaq, Yahoo Finance — “The Magnificent Seven Propel ~55% of the S&P 500’s 2024 Gains.”

CAPE backdrop (Shiller P/E). The ratio—price divided by 10 years of inflation-adjusted earnings (shown above on the banner)—is designed to smooth cycles. The latest reading is ~40.2 (Oct 2025), while long-run norms sit closer to 17–18. Peaks above 32 showed up in 1929 and 1999–2000. CAPE doesn’t mark tops; it frames the weather. At elevated levels, expectations feel like tightrope wire: elegant, but less forgiving.

Cash as Signal: Berkshire’s War Chest & the P/E Backdrop

In Omaha, the runway lights look different. Berkshire Hathaway holds roughly $344B in cash—the largest corporate cash pile on record—after nearly doubling in just over a year. Companies build cash for storms, for opportunities, or when prices don’t make sense.

Here’s the valuation backdrop: the S&P 500 trailing P/E sits near ~30×, roughly 67% above its long-run median (~17.9), while the Shiller P/E (CAPE) is ~40.2. The mood it sketches: lift is available, but fuel is precious.

Debt Math: The Backdrop to Both Stories

Think of it like a tab that never stops ticking. The U.S. Treasury’s Debt to the Penny tally puts federal debt at about $38 trillion (Oct 2025), counting both intragovernmental holdings and debt held by the public. Because borrowing needs are high and rates are higher than a few years ago, the interest bill alone now runs above $1 trillion a year.

In plain English: more of every federal dollar goes to interest before anything else. That doesn’t automatically end a stock rally or set the gold price, but it raises the background risk both stories live with—like flying with a little more headwind than the instruments first suggest.

✅ Beyond Growth Takeaways

- Gold’s role endures: Day-to-day volatility aside, the central-bank bid remains a key pillar of demand.

- Narrow leadership: Index strength is concentrated in a handful of mega-caps; breadth is the weak link.

- Valuation altitude: CAPE ~40 and trailing P/E ~30× indicate a thin-air regime with a smaller margin for error.

- Cash as a clue: Berkshire’s ~$344B cash pile is a notable signal about opportunity sets and pricing.

- Debt arithmetic: ~$38T federal debt and >$1T annual interest are a structural headwind in the background.

- Watch these basics: the dollar, interest rates, U.S.–China trade news, and central-bank gold buying—they shape the mood in the room.

Closing Play: The Room, the Plane, the Pause

Gold moving into official vaults—with sharp air-pockets along the way. Equities gliding on narrow lift. Cash pooling on the sidelines. Debt costs humming in the background. The same room, two currents. Paper planes fly as long as the air holds; anchors sit where they are placed.

Reality or fiction won’t be decided by a headline—it will be decided by breadth, earnings that meet their promises, and balance sheets that don’t flinch when the room shifts.

Disclaimer: This article is for information and discussion only and is not financial advice.

For guidance specific to your situation, please consult a qualified financial advisor to understand current market conditions and the reality of your financial holdings.

References:

- China Gold Reserves: https://tradingeconomics.com/china/gold-reserves

- Shiller P/E ratio - Latest: https://www.multpl.com/shiller-pe

- National Debt of the United States: https://en.wikipedia.org/wiki/National_debt_of_the_United_States

- US Debt Dashboard: https://www.jec.senate.gov/public/index.cfm/republicans/debt-dashboard

- Gold and Silver Plunge: Steepest Drop in Years

- S&P 500's 2024 Gains - Magnificent 7

🤝 Let’s Collaborate

I’m a Canada-based entrepreneur and business growth consultant working where CPG, media, and technology meet. If today’s markets feel like paperplanes in thin air—high, fast, and fragile—my work is about building the anchors: optionality, new channels, and durable revenue.

What I help with

- 🌍 Trade & Diversification — new buyers, smarter routes, resilience beyond one market

- 🛒 CPG Strategy & Insights — product, pricing, and go-to-market powered by usable data and real consumer signals

- 📺 Media & Digital Platforms — FAST channels, partnerships, and scalable workflows that monetize and build owned audiences

As wellness, media, and consumer experiences are being reimagined, the winners combine value + technology + conscious choices to create growth that lasts—through stretched valuations, shifting tariffs, and changing capital costs.

🌐 Building something new?

If you’re looking for a reliable hosting provider, I’d recommend DreamHost.

We’ve used it for our client websites for over a decade — it’s fast, secure, and built for creators who want peace of mind.

🔔 Stay Connected

If this analysis on gold, breadth, and debt math resonated, let’s keep the conversation going.

👉 Subscribe to my newsletter on entrepreneurship, media, AI, and creative growth: iamgrt.kit.com